Capacity Market

The Capacity Market (CM) is part of the Electricity Market Reform programme. It ensures the UK has enough electricity to meet future demand.

The CM aims to keep electricity costs low for consumers by allowing energy providers to earn payments for being available when needed. Below you can find information on the steps to participate in the CM: Capacity Setting, Pre-qualification, Auction, Agreement Management, and Delivery. Each step is important for the market to work efficiently.

Capacity Market (CM) Interactive

Electricity Capacity Report

The first step in the Capacity Market is to determine how much electricity the UK will need in the future. We analyse data and produce the Electricity Capacity Report to help the government decide on the capacity for each auction.

Key aspects of capacity setting

Each year, we produce an Electricity Capacity Report with proposals for the capacity needed to ensure supply security. All reports can be accessed on the Electricity Capacity Report (ECR) page.

This process involves refining the demand curve to ensure the auction secures the right amount of capacity. According to Capacity Market rules, we must advise the Secretary of State on any necessary adjustments to the demand curve after the pre-qualification process, or based on new information. Our recommendations, especially for the T-1 and T-4 auctions, are included in the Demand Curve Adjustment Report.

The Capacity Market recognises that no electricity generation technology is available 100% of the time. De-rating factors are used to reflect the expected availability of different generation types, like wind and solar, whose output can vary. These factors help ensure the secured capacity meets the government's reliability standard. More information on de-rating factors and related projects can be found in the De-rating Factor methodology.

Pre-qualification

Pre-qualification is the step where companies sign up and prove they can join the Capacity Market auction. It makes sure all companies can provide electricity when needed. This process ensures that all participants meet the required standard to deliver capacity when needed.

Steps in Pre-qualification

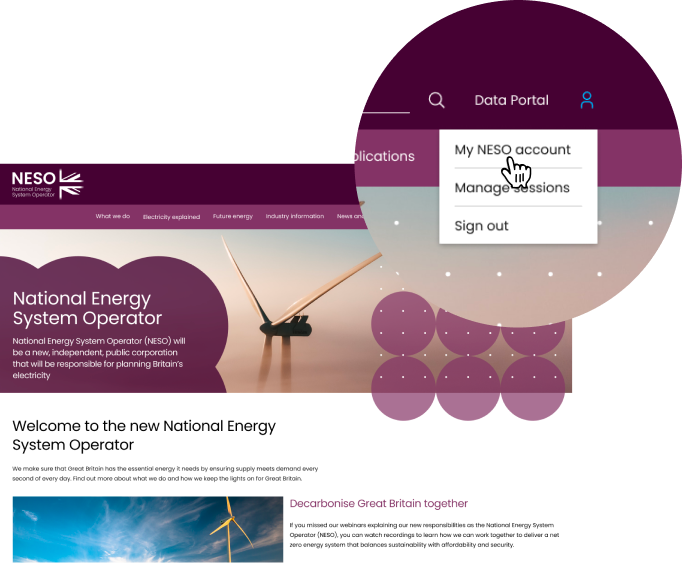

Participants must register on the EMR portal, create user credentials, and set up their Capacity Market Unit (CMU) and components. The registration is open all year. Once registered, participants can add users to their account, add companies to their portfolio, and create generating units for the Capacity Market Auctions.

After registering, participants submit their pre-qualification applications with all necessary exhibits and information. This process usually occurs over eight weeks, from July to September, through the EMR DB Portal.

Applications are reviewed, and results are released on pre-qualification results day. If a participant is conditionally prequalified, they must complete additional activities to address any outstanding requirements.

If an applicant disagrees with the prequalification assessment outcome, they can raise a dispute in the EMR DB Portal to have the decision reviewed.

After all applications are assessed and disputes are resolved, successful applicants will enter the capacity auction and complete any pre-auction activities.

Capacity Market Auction

The Capacity Market Auction is a competitive process to award agreements for the target delivery year. Only prequalified Capacity Market Units (CMUs) that have confirmed their entry can participate.

The auction uses a descending clock format, where participants bid for the lowest price they are willing to provide capacity. It continues until the required capacity is secured at the best price.

- Pre-Auction Activities: Before the auction, participants can attend practice auctions, webinars, and training sessions to improve their bidding strategy. They can also review the final Capacity Market Register.

- D-15 to D-10 activities: Eligible applicants should complete necessary tasks for their CMU type, such as confirming entry, max obligation period, and DSR bidding capacity.

- Mock Auction: Applicants will take part in the Mock Auction. This is also an opportunity to check data, test Auction system credentials, and learn about the Auction system.

- Auction Results & CAN Release: Results are published eight working days after the auction clears. The Capacity Agreements (CANs) are issued 20 working days later. We have published some further guidance to help you.

The T-1 Capacity Auction for 2025/26 ended on 5 March 2025 at 10:00 GMT. It procured 7,936.289 MW across 246 Capacity Market Units (CMUs).

The T-4 Capacity Auction for 2028/29 ended on 11 March 2025 at 11:30 GMT. It procured 43,055.073 MW across 669 Capacity Market Units (CMUs).

This section is updated only during live auctions to provide round-by-round results. We also publish Final Results Reports for all Capacity Auctions.

Agreement Management

After getting capacity agreements, participants move to the agreement management stage. Here, they must follow the rules of the capacity market. Different types of capacity market units (CMUs) have different rules. These rules depend on whether the units are new, already existing, or demand-side response (DSR) units.

Prospective CMUs (New Build & Refurbishing CMUs)

New and refurbishing Capacity Market Units (CMUs) have certain tasks to complete before they start working. These tasks make sure the project will be ready on time and work well for the whole agreement period.

Existing CMUs

Existing Capacity Market Units (CMUs) are sites that are already set up and working. They must make sure they can provide electricity during the year their agreement covers.

Demand Side Response (DSR) CMUs

Demand Side Response (DSR) units are divided into two types: proven and unproven. Proven DSR units must make sure they can provide electricity during the year their agreement covers. Unproven DSR units have the same job, but they must pass a test first to show they are working.

Other useful information

If a Capacity Market Unit (CMU) doesn't follow the important rules, their capacity agreement can be canceled. The delivery body (DB) will send a cancellation notice to the capacity provider. The provider can then either argue against the cancellation with the DB or ask the Secretary of State to cancel or extend the notice.

Capacity Market participants might get penalised if they cannot meet their capacity obligations. They can avoid this risk by trading their capacity obligation to another provider before any issues arise or by reallocating their volume to another provider after a stress event.

Capacity Providers can ask the delivery body to review these things for any of their Capacity Market Units (CMUs):

- Change the address for any new or Demand Side Response (DSR) CMU.

- Register a security interest.

- Transfer a CMU to another company.

- Investigate a mistake in any capacity market register or agreement

Once capacity agreements are in place, providers must meet their obligations from 1 October to 30 September. For example, the 2024 delivery year runs from 1 October 2024 to 30 September 2025.

Capacity Market Notices

A Capacity Market Notice is a warning given four hours in advance if there might be less electricity available than needed. This notice means there is a higher risk of a System Stress Event, where the electricity supply might not meet demand. These notices are automatically sent by NESO on gbcmn.nationalenergyso.com.

During a System Stress Event

Providers must supply their promised electricity during times of system stress, which can happen due to shortages or high demand. If they fail to do so, they may face financial penalties.

This process helps ensure the Capacity Market works well, securing the UK's electricity supply and giving energy providers a chance to participate. For more information, visit our knowledge site.